7754380374 Smart Stock Picks for Every Investor

The landscape of stock investing requires a disciplined approach grounded in rigorous analysis and strategic diversification. Identifying resilient stocks that align with varied financial objectives involves evaluating fundamental strength, market trends, and risk profiles. Understanding how to construct a portfolio that balances stability with growth potential can significantly impact long-term success. Exploring these criteria reveals the nuances behind effective stock selection, prompting investors to consider whether their current strategies are truly optimized for sustained resilience.

Key Criteria for Selecting Top Stocks

Effective stock selection hinges on a rigorous evaluation of key criteria that distinguish enduring performers from transient market trends.

Analyzing dividend yield alongside growth potential reveals resilient companies capable of providing consistent income and expansion.

This strategic approach empowers investors seeking freedom through informed choices, emphasizing stability and upside potential rather than short-term fluctuations or speculative gains.

Diverse Investment Strategies for Different Goals

How investors align their strategies with specific financial goals significantly influences portfolio design and risk management.

For income-focused objectives, dividend investing offers stability and cash flow, while growth stocks cater to those seeking capital appreciation.

Diversifying across these strategies enables tailored risk exposure, empowering investors to attain financial freedom aligned with their unique aspirations.

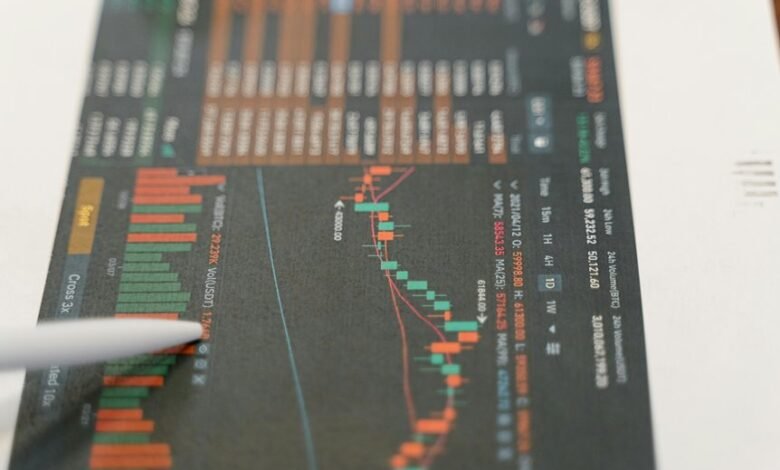

Analyzing Market Trends and Data Insights

Analyzing market trends and data insights forms the backbone of informed investment decision-making, enabling investors to anticipate shifts and adapt strategies accordingly.

By scrutinizing cryptocurrency volatility and emerging markets, investors can identify opportunities and manage risks effectively.

Strategic analysis of these dynamic factors fosters a liberated approach, empowering investors to navigate uncertainties with confidence and precision.

Tips for Building a Resilient Portfolio

What strategic approaches can investors employ to construct a resilient portfolio capable of withstanding market fluctuations? Emphasizing risk management through diversification, integrating dividend investing for steady income, and balancing growth with defensive assets are essential.

These methods foster resilience, enabling investors to maintain financial freedom amid volatility by reducing downside risk and ensuring consistent cash flow.

Conclusion

Ultimately, selecting the right stocks requires a disciplined approach grounded in thorough analysis and strategic diversification. By adhering to well-defined criteria and understanding market trends, investors can navigate volatility and build resilience. Recognizing that no investment is foolproof underscores the importance of adaptable strategies. As the saying goes, “don’t put all your eggs in one basket,” emphasizing that prudent risk management is essential for long-term financial stability and growth.